THE FOUNDING OF RPM

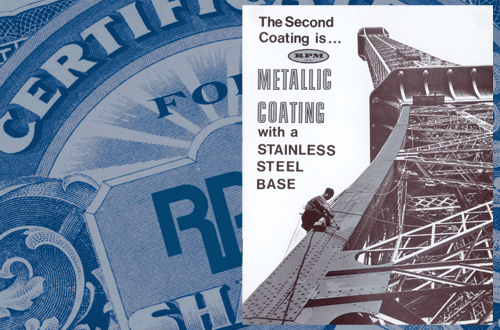

In May 1947, Frank C. Sullivan founded Republic Powdered Metals—the forerunner to RPM International Inc. The original product was a heavy-duty aluminum roof coating called Alumanation, which is still sold today. In that first year, sales reached $90,000.

RPM PAVES THE WAY FOR A NATIONAL PUBLIC STOCK OFFERING

After more than 15 years of private ownership, Republic Powdered Metals sold 25,000 shares of common stock to the public in an intrastate offering in Ohio in 1963. The shares sold out in 48 hours and paved the way for a national public stock offering a few years later.

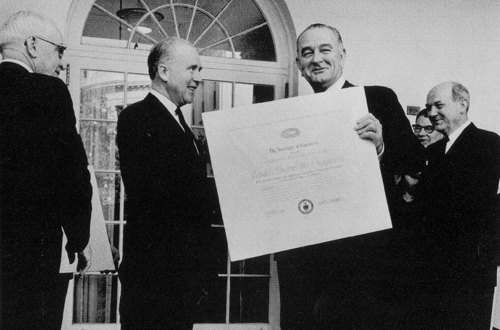

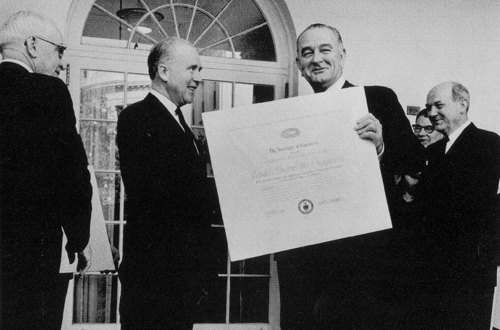

EXPORT PROGRAM RECOGNIZED BY THE WHITE HOUSE

The company received the prestigious “E” Award in 1964 at a personal White House presentation from U.S. President Johnson for its outstanding contributions to the country’s export expansion program.

REPUBLIC POWDERED METALS COMPLETES FIRST ACQUISITION

Republic Powdered Metals completed its first acquisition in 1966 with the purchase of The Reardon Company of St. Louis for $2.3 million. Reardon, founded in 1883, was credited with being the first to develop cement-based paints and coatings.

ACQUISITION PLAN LEADS TO STRATEGIC GROWTH

In August 1971, Frank C. Sullivan, founder of RPM, died suddenly in his sleep. Tom Sullivan assumed leadership of RPM, taking over where his father left off. Later that year, RPM, Inc. was formed with the vision of developing a more aggressive acquisition program in a rapidly consolidating paint and coatings industry.

RPM LISTS ON NASDAQ

RPM was listed on the NASDAQ stock exchange in 1971, trading under the symbol RPOW.

RPM DECLARES A 50 PERCENT STOCK DIVIDEND

In 1975, RPM declared a 50 percent stock dividend to its shareholders, an action that would recur over the next three years. That same year, Barron’s a weekly Wall Street publication, reported that RPM was among the top 15 paint firms in the industry and declared that the company’s “Broad Mix of Protective Coatings Adds Luster to Results of RPM.”

CORPORATE STRATEGY SHIFTS TO ACCELERATE GROWTH

In 1979, just as RPM achieved the milestone of $100 million in annual sales, three of the company’s outside directors recommended actions that would drive RPM’s long-term growth. They called for divesting non-core companies, implementing an annual plan at the operating level and creating cooperation among the operating companies.

POSITION IN CONCRETE SOLUTIONS SOLIDIFIED WITH EUCLID ACQUISITION

In 1984, RPM acquired the Euclid Chemical Company, a leading manufacturer of concrete additives, masonry, waterproofing products and grouting materials, based in Cleveland.

CARBOLINE JOINS RPM AFTER A LONG PURSUIT

In 1985, RPM made its largest deal to date with the acquisition of industrial corrosion control coatings manufacturer Carboline Company. This was a strategic transaction Tom Sullivan had been pursuing for more than a decade.

DEDICATION DRIVES SUCCESS

In 1987, RPM achieved a 40-year streak of consecutive record sales, net income and earnings per share.

FUTURE LOOKS BRIGHT AFTER DAYGLO ACQUISITION

DayGlo Color Corp., a maker of fluorescent colorants and pigments, was acquired in 1991. Its products are used to brighten everything from safety equipment and consumer packaging to sporting goods and apparel.

STONHARD ACQUISTION GIVES RPM FIRM FOOTING

Stonhard, a leading manufacturer and installer of seamless polymer flooring systems, was acquired by RPM in 1993. Its products are used across a broad range of industries including manufacturing, healthcare, food processing, technology, entertainment, retail and others.

LEADING CONSUMER PAINT BRAND RUST-OLEUM ACQUIRED

RPM opened a back door to Rust-Oleum Corporation with the strategic acquisition of its European operation in 1991. It completed the deal in 1994 when it acquired the rest of the business, adding one of the most recognizable consumer paint brands to its portfolio.

RPM NAMED TO FORTUNE 500

RPM was named to the venerable Fortune 500 list in 1994. At the time, the list was comprised of the world’s largest industrial manufacturers.

SALES SURPASS $1 BILLION

In 1995, RPM’s sales for the year surpassed $1 billion, a 25 percent increase from the previous year. The same year, Frank C. Sullivan, Tom Sullivan’s son, was named RPM’s executive vice president and was elected to the company’s board of directors.

TREMCO PURCHASE EXPANDS CONSTRUCTION PRODUCTS PORTFOLIO

RPM made several acquisitions in 1997, the largest of which was the purchase of Tremco Inc., an industrial sealants and roofing manufacturer for $236 million. It served as the platform for the Construction Products Group, RPM’s largest operating segment today.

A GOLDEN ANNIVERSARY

In 1997, RPM celebrated its 50th anniversary and five consecutive decades of record sales and earnings. In recognition of this momentous achievement, the world-renowned Cleveland Orchestra performed for more than 5,000 RPM shareholders at the company’s annual meeting.

RPM MOVES TO THE NYSE

With nearly 7,000 employees and products in more than 130 countries, RPM switched from NASDAQ to the New York Stock Exchange and began trading under the symbol RPM. Sales that year were $1.6 billion with net income of $149.6 million.

DEAL IS SEALED WITH DAP ACQUISITION

RPM added another highly regarded consumer brand to its portfolio in 1999 when it acquired DAP Products, a manufacturer and marketer of caulks, sealants, adhesives, and patch and repair products.

RPM UNDERTAKES AMBITIOUS REORGANIZATION PROGRAM

RPM initiated an ambitious reorganization program that would consolidate many of its businesses and position it for future growth.

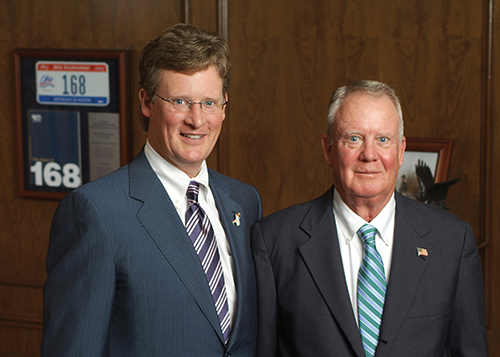

TOM SULLIVAN RETIRES AFTER 30+ YEARS OF SUCCESS

Following more than 30 years at the helm of RPM, Tom Sullivan and Jim Karman retired as executive officers of the company in 2002. During their tenure, net sales increased from $11 million to $2 billion. A $1,000 investment in RPM shares in 1971, when Tom became CEO, was worth more than $100,000 by 2002—a testament to their leadership. Tom was succeeded by his son, Frank C. Sullivan, who became president and chief executive officer.

EUROPEAN PRESENCE GROWS WITH ILLBRUCK ACQUISITION

RPM expanded its European presence with the strategic acquisition of illbruck Sealant Systems, which was headquartered in Cologne, Germany.

RPM EXPANDS ITS GLOBAL FOOTPRINT

From 2003 to 2008, RPM’s subsidiaries continued to grow and acquire other companies. In 2008, RPM expanded its global footprint by acquiring nine companies with $200 million in combined annual sales.

ACQUISITIONS BROADEN SOUTH AMERICAN PRESENCE

Between 2007 and 2014, RPM acquired Viapol, Betumat and Cave, expanding its reach into emerging South America markets.

RPM ANNOUNCES MAP TO GROWTH

At a 2018 investor day, RPM announced its operating improvement program— the MAP (Margin Acceleration Plan) to Growth. The program included initiatives to drive greater efficiency in order to accelerate growth and increase value from the unique entrepreneurial culture and leading brands that have been the foundation of RPM’s success for decades.

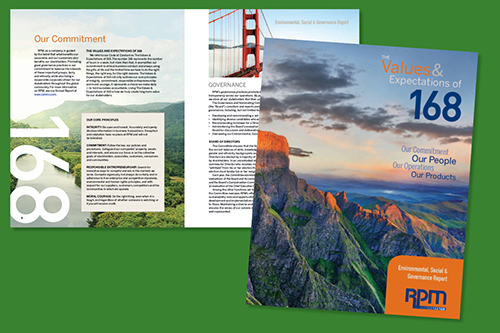

THE FIRST ESG REPORT IS RELEASED

In 2020, RPM released its first Environmental, Social and Governance (ESG) Report highlighting the company’s safe, ethical and sustainable business practices, which result in value creation for RPM’s key stakeholders and help to build a better world for all.

RPM NAMED TO FORTUNE 500 LIST

With revenues of approximately $5.5 billion for its fiscal year ended May 31, 2020, RPM ranked number 489 on the Fortune 500.

RPM SUCCESSFULLY COMPLETES MAP TO GROWTH PROGRAM

At the end of fiscal year 2021, RPM successfully completed its MAP to Growth operating improvement program. The company achieved a run rate of $320 million in annualized savings, exceeding its target by $30 million. RPM also significantly improved its profit margin profile and cash generation.

RPM CELEBRATES 75 YEARS

RPM celebrated 75 years of success in 2022.

RPM Achieves Dividend Milestone

At its 2023 Annual Meeting, RPM announced its 50th consecutive year of cash dividend increases.

RPM SECURES SPOT ON FORTUNE 500 LIST

With revenues of approximately $7.3 billion for its fiscal year ended May 31, 2023, RPM ranked number 492 on the Fortune 500.

THE FOUNDING OF RPM

In May 1947, Frank C. Sullivan founded Republic Powdered Metals—the forerunner to RPM International Inc. The original product was a heavy-duty aluminum roof coating called Alumanation, which is still sold today. In that first year, sales reached $90,000.

RPM PAVES THE WAY FOR A NATIONAL PUBLIC STOCK OFFERING

After more than 15 years of private ownership, Republic Powdered Metals sold 25,000 shares of common stock to the public in an intrastate offering in Ohio in 1963. The shares sold out in 48 hours and paved the way for a national public stock offering a few years later.

EXPORT PROGRAM RECOGNIZED BY THE WHITE HOUSE

The company received the prestigious “E” Award in 1964 at a personal White House presentation from U.S. President Johnson for its outstanding contributions to the country’s export expansion program.

REPUBLIC POWDERED METALS COMPLETES FIRST ACQUISITION

Republic Powdered Metals completed its first acquisition in 1966 with the purchase of The Reardon Company of St. Louis for $2.3 million. Reardon, founded in 1883, was credited with being the first to develop cement-based paints and coatings.

ACQUISITION PLAN LEADS TO STRATEGIC GROWTH

In August 1971, Frank C. Sullivan, founder of RPM, died suddenly in his sleep. Tom Sullivan assumed leadership of RPM, taking over where his father left off. Later that year, RPM, Inc. was formed with the vision of developing a more aggressive acquisition program in a rapidly consolidating paint and coatings industry.

RPM LISTS ON NASDAQ

RPM was listed on the NASDAQ stock exchange in 1971, trading under the symbol RPOW.

RPM DECLARES A 50 PERCENT STOCK DIVIDEND

In 1975, RPM declared a 50 percent stock dividend to its shareholders, an action that would recur over the next three years. That same year, Barron’s a weekly Wall Street publication, reported that RPM was among the top 15 paint firms in the industry and declared that the company’s “Broad Mix of Protective Coatings Adds Luster to Results of RPM.”

CORPORATE STRATEGY SHIFTS TO ACCELERATE GROWTH

In 1979, just as RPM achieved the milestone of $100 million in annual sales, three of the company’s outside directors recommended actions that would drive RPM’s long-term growth. They called for divesting non-core companies, implementing an annual plan at the operating level and creating cooperation among the operating companies.

POSITION IN CONCRETE SOLUTIONS SOLIDIFIED WITH EUCLID ACQUISITION

In 1984, RPM acquired the Euclid Chemical Company, a leading manufacturer of concrete additives, masonry, waterproofing products and grouting materials, based in Cleveland.

CARBOLINE JOINS RPM AFTER A LONG PURSUIT

In 1985, RPM made its largest deal to date with the acquisition of industrial corrosion control coatings manufacturer Carboline Company. This was a strategic transaction Tom Sullivan had been pursuing for more than a decade.

DEDICATION DRIVES SUCCESS

In 1987, RPM achieved a 40-year streak of consecutive record sales, net income and earnings per share.

FUTURE LOOKS BRIGHT AFTER DAYGLO ACQUISITION

DayGlo Color Corp., a maker of fluorescent colorants and pigments, was acquired in 1991. Its products are used to brighten everything from safety equipment and consumer packaging to sporting goods and apparel.

STONHARD ACQUISTION GIVES RPM FIRM FOOTING

Stonhard, a leading manufacturer and installer of seamless polymer flooring systems, was acquired by RPM in 1993. Its products are used across a broad range of industries including manufacturing, healthcare, food processing, technology, entertainment, retail and others.

LEADING CONSUMER PAINT BRAND RUST-OLEUM ACQUIRED

RPM opened a back door to Rust-Oleum Corporation with the strategic acquisition of its European operation in 1991. It completed the deal in 1994 when it acquired the rest of the business, adding one of the most recognizable consumer paint brands to its portfolio.

RPM NAMED TO FORTUNE 500

RPM was named to the venerable Fortune 500 list in 1994. At the time, the list was comprised of the world’s largest industrial manufacturers.

SALES SURPASS $1 BILLION

In 1995, RPM’s sales for the year surpassed $1 billion, a 25 percent increase from the previous year. The same year, Frank C. Sullivan, Tom Sullivan’s son, was named RPM’s executive vice president and was elected to the company’s board of directors.

TREMCO PURCHASE EXPANDS CONSTRUCTION PRODUCTS PORTFOLIO

RPM made several acquisitions in 1997, the largest of which was the purchase of Tremco Inc., an industrial sealants and roofing manufacturer for $236 million. It served as the platform for the Construction Products Group, RPM’s largest operating segment today.

A GOLDEN ANNIVERSARY

In 1997, RPM celebrated its 50th anniversary and five consecutive decades of record sales and earnings. In recognition of this momentous achievement, the world-renowned Cleveland Orchestra performed for more than 5,000 RPM shareholders at the company’s annual meeting.

RPM MOVES TO THE NYSE

With nearly 7,000 employees and products in more than 130 countries, RPM switched from NASDAQ to the New York Stock Exchange and began trading under the symbol RPM. Sales that year were $1.6 billion with net income of $149.6 million.

DEAL IS SEALED WITH DAP ACQUISITION

RPM added another highly regarded consumer brand to its portfolio in 1999 when it acquired DAP Products, a manufacturer and marketer of caulks, sealants, adhesives, and patch and repair products.

RPM UNDERTAKES AMBITIOUS REORGANIZATION PROGRAM

RPM initiated an ambitious reorganization program that would consolidate many of its businesses and position it for future growth.

TOM SULLIVAN RETIRES AFTER 30+ YEARS OF SUCCESS

Following more than 30 years at the helm of RPM, Tom Sullivan and Jim Karman retired as executive officers of the company in 2002. During their tenure, net sales increased from $11 million to $2 billion. A $1,000 investment in RPM shares in 1971, when Tom became CEO, was worth more than $100,000 by 2002—a testament to their leadership. Tom was succeeded by his son, Frank C. Sullivan, who became president and chief executive officer.

EUROPEAN PRESENCE GROWS WITH ILLBRUCK ACQUISITION

RPM expanded its European presence with the strategic acquisition of illbruck Sealant Systems, which was headquartered in Cologne, Germany.

RPM EXPANDS ITS GLOBAL FOOTPRINT

From 2003 to 2008, RPM’s subsidiaries continued to grow and acquire other companies. In 2008, RPM expanded its global footprint by acquiring nine companies with $200 million in combined annual sales.

ACQUISITIONS BROADEN SOUTH AMERICAN PRESENCE

Between 2007 and 2014, RPM acquired Viapol, Betumat and Cave, expanding its reach into emerging South America markets.

RPM ANNOUNCES MAP TO GROWTH

At a 2018 investor day, RPM announced its operating improvement program— the MAP (Margin Acceleration Plan) to Growth. The program included initiatives to drive greater efficiency in order to accelerate growth and increase value from the unique entrepreneurial culture and leading brands that have been the foundation of RPM’s success for decades.

THE FIRST ESG REPORT IS RELEASED

In 2020, RPM released its first Environmental, Social and Governance (ESG) Report highlighting the company’s safe, ethical and sustainable business practices, which result in value creation for RPM’s key stakeholders and help to build a better world for all.

RPM NAMED TO FORTUNE 500 LIST

With revenues of approximately $5.5 billion for its fiscal year ended May 31, 2020, RPM ranked number 489 on the Fortune 500.

RPM SUCCESSFULLY COMPLETES MAP TO GROWTH PROGRAM

At the end of fiscal year 2021, RPM successfully completed its MAP to Growth operating improvement program. The company achieved a run rate of $320 million in annualized savings, exceeding its target by $30 million. RPM also significantly improved its profit margin profile and cash generation.

RPM CELEBRATES 75 YEARS

RPM celebrated 75 years of success in 2022.

RPM Achieves Dividend Milestone

At its 2023 Annual Meeting, RPM announced its 50th consecutive year of cash dividend increases.

RPM SECURES SPOT ON FORTUNE 500 LIST

With revenues of approximately $7.3 billion for its fiscal year ended May 31, 2023, RPM ranked number 492 on the Fortune 500.